You are here:Chùa Bình Long – Phan Thiết > news

What's Driving Bitcoin Price: A Comprehensive Analysis

Chùa Bình Long – Phan Thiết2024-09-22 02:01:03【news】3people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In recent years, Bitcoin has emerged as one of the most talked-about digital currencies in the world airdrop,dex,cex,markets,trade value chart,buy,In recent years, Bitcoin has emerged as one of the most talked-about digital currencies in the world

In recent years, Bitcoin has emerged as one of the most talked-about digital currencies in the world. Its price has experienced significant volatility, attracting both investors and critics. Many people are curious about what's driving Bitcoin price, and this article aims to provide a comprehensive analysis of the factors that influence its value.

Firstly, the supply and demand dynamics play a crucial role in determining Bitcoin's price. As a finite digital currency, Bitcoin has a maximum supply of 21 million coins. This scarcity has created a sense of urgency among investors, leading to increased demand and, consequently, higher prices. On the other hand, when demand decreases, Bitcoin's price may fall. Various factors can influence demand, such as regulatory news, market sentiment, and technological advancements.

What's driving Bitcoin price is also influenced by regulatory news. Governments and financial authorities around the world have been closely monitoring the cryptocurrency market, and their policies can significantly impact Bitcoin's value. For instance, if a country legalizes Bitcoin, it may boost investor confidence and drive up the price. Conversely, if a government bans or restricts the use of Bitcoin, it could lead to a decrease in demand and a subsequent drop in price.

Market sentiment is another critical factor that affects Bitcoin's price. Investors often react to news and rumors, which can cause the market to become highly speculative. For example, when Bitcoin reaches a new all-time high, some investors may become overly optimistic, leading to a speculative bubble. This bubble can burst when the market realizes that the price is no longer justified by the underlying fundamentals. In such cases, Bitcoin's price may plummet, as we have seen in the past.

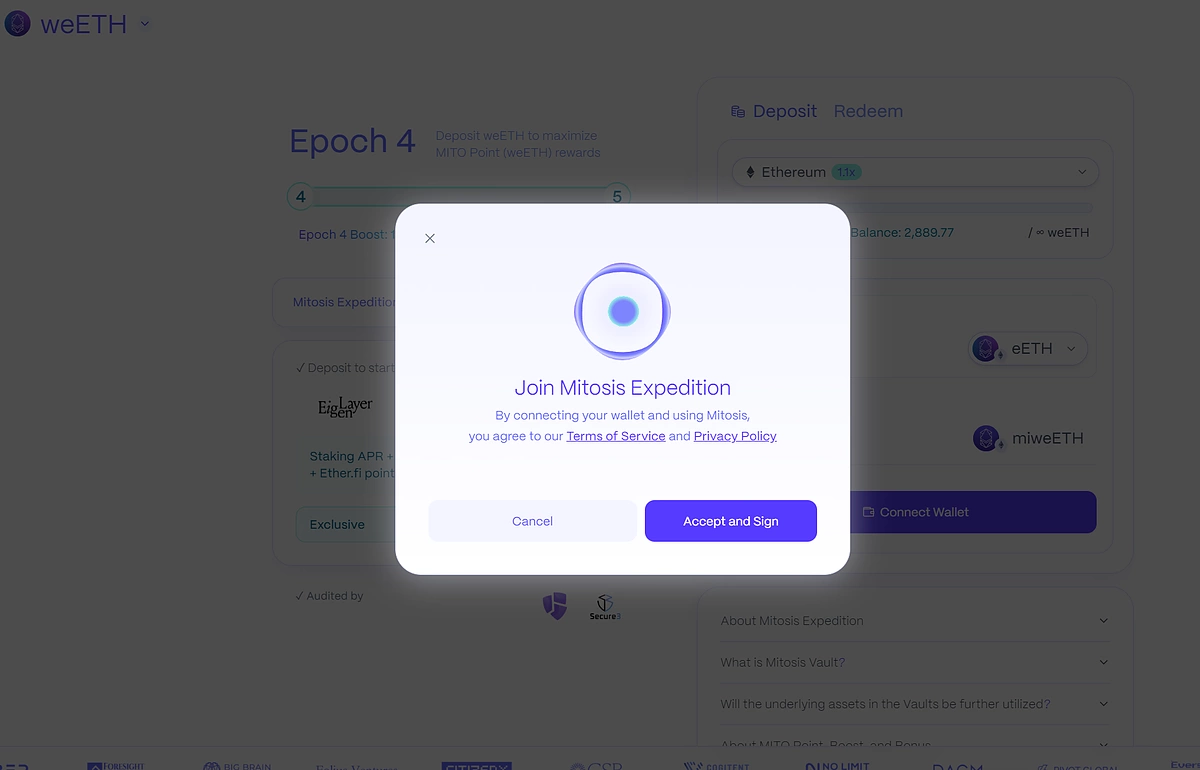

Technological advancements also play a significant role in what's driving Bitcoin price. The blockchain technology underlying Bitcoin is constantly evolving, with new innovations and improvements being introduced. For instance, the development of faster and more secure blockchain networks can enhance Bitcoin's utility and, in turn, increase its value. Additionally, the rise of decentralized finance (DeFi) and non-fungible tokens (NFTs) has contributed to the growing interest in Bitcoin and other cryptocurrencies.

Moreover, institutional adoption is a key driver of Bitcoin's price. As more institutional investors enter the market, they bring substantial capital and expertise, which can significantly impact Bitcoin's value. For example, when a major financial institution like Fidelity Investments or Grayscale Investments announces a Bitcoin investment product, it can attract a wave of new investors and drive up the price.

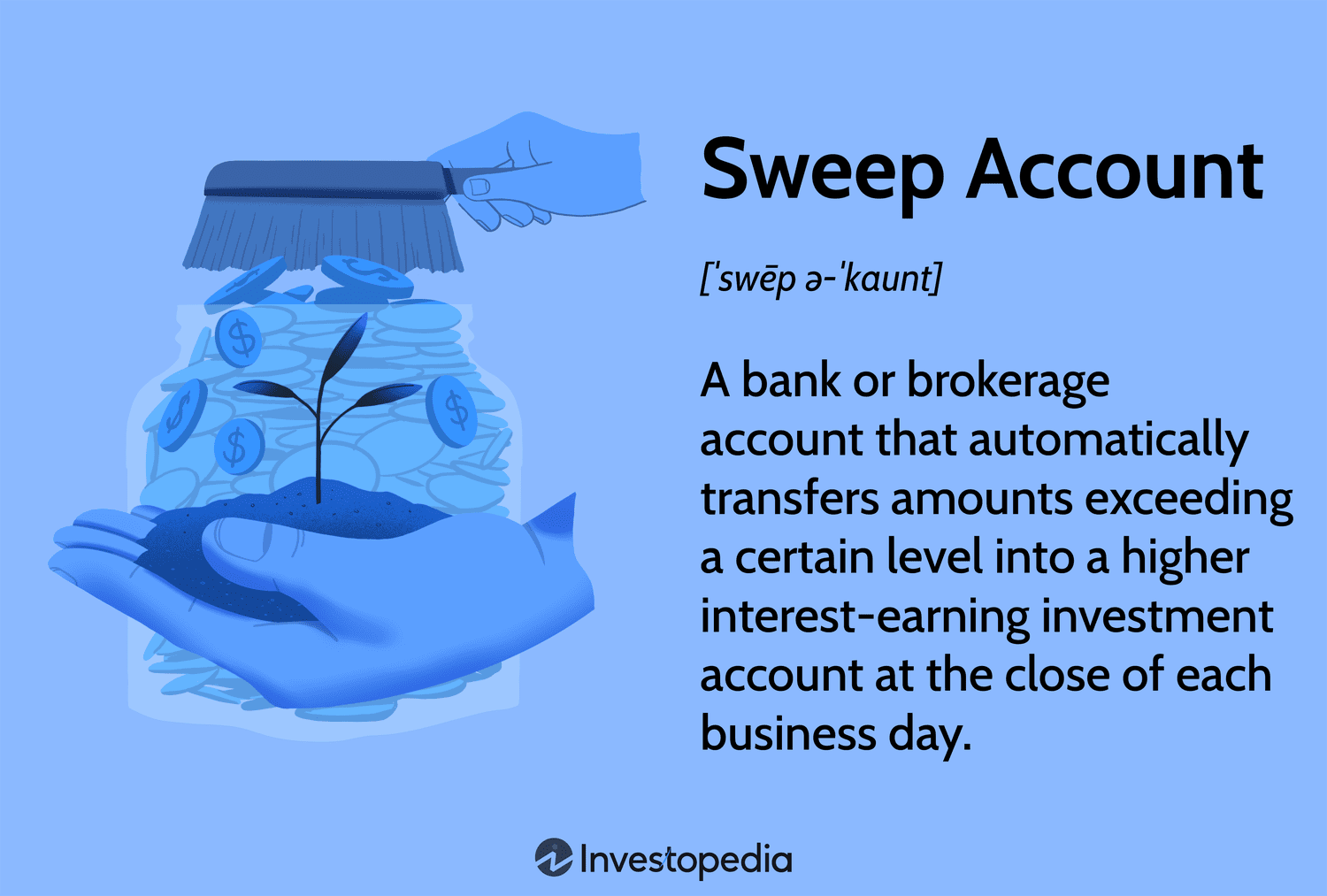

Lastly, the correlation between Bitcoin and traditional financial markets is another factor that influences its price. As Bitcoin has become more widely recognized as a store of value, it has started to exhibit some correlation with traditional assets like stocks and commodities. For instance, during times of economic uncertainty, investors may turn to Bitcoin as a safe haven, leading to an increase in its price.

In conclusion, what's driving Bitcoin price is a complex interplay of various factors, including supply and demand dynamics, regulatory news, market sentiment, technological advancements, institutional adoption, and correlation with traditional financial markets. Understanding these factors can help investors make informed decisions and navigate the volatile cryptocurrency market.

This article address:https://www.binhlongphanthiet.com/blog/24e63299343.html

Like!(58)

Related Posts

- ### The Evolution of Binance Chain Network to Binance Smart Chain: A Comprehensive Overview

- Bitcoin Price on January 19, 2017: A Milestone in Cryptocurrency History

- ### Smart Trade System for Binance: Revolutionizing Cryptocurrency Trading

- **Converting 0.17663307 Bitcoin Cash to AUD: A Comprehensive Guide

- Get Bitcoin Wallet Info: A Comprehensive Guide to Managing Your Cryptocurrency Assets

- Binance Cant See Wallet: A Common Issue and Its Solutions

- Macworld.uk Bitcoin Mining: The Rise of Crypto Mining on Apple Devices

- How to Send Bitcoin from Your LocalBitcoins Wallet

- Bitcoin Cash BCC Manually Create TX: A Comprehensive Guide

- Binance Defi Price: A Comprehensive Analysis

Popular

Recent

Bitcoin Price Prediction Using Python Code: A Comprehensive Guide

002 Bitcoin Cash to USD: A Comprehensive Analysis

Bitcoin Wallet Referral Code: Unlocking the Potential of Cryptocurrency

Price Prediction of Bitcoin 2019: A Look Back at the Cryptocurrency's Turbulent Year

How to Find Bitcoin Wallet Address: A Comprehensive Guide

Bitcoin Cash Casino Bonus: A Game-Changing Incentive for Players

**Today's Price of Bitcoin in India: A Comprehensive Overview

How to Send Bitcoin from Your LocalBitcoins Wallet

links

- Mining Bitcoins: The Rise of Slush& 39

- The Evolution of Digital Currencies: Tron to Bitcoin Cash

- Bitcoin ATM Locator Canada: A Comprehensive Guide to Finding Bitcoin ATMs in Canada

- Why Bitcoin Cash Went Up: The Factors Behind the Surge

- The Rise of the RTX 3080 Bitcoin Mining Calculator: A Game Changer for Crypto Miners

- Mining Bitcoin on the Go: A Comprehensive Guide

- Best Bitcoin Mining 2018: A Comprehensive Guide to the Top Mining Hardware and Strategies

- Bitcoin Wallet Blockchain Info: Understanding the Basics

- Title: Streamlining Bitcoin Transactions: The Cash Out Bitcoin Circle App Experience

- How to Turn Old Server into Bitcoin Mining Machine